American Express Platinum Travel Credit Card is a great option for frequent travelers in India. It offers welcome rewards in the form of Membership Rewards Points, which can be redeemed for travel bookings or shopping vouchers. You also earn milestone rewards like Taj vouchers and free stays after reaching specific spending levels. Additionally, you earn 1 Membership Rewards Point for every ₹50 spent, helping you accumulate rewards quickly.

This card is designed to make travel more convenient and comfortable. It provides free access to airport lounges and includes a Priority Pass membership for access to premium lounges worldwide. The points can be used for flights, hotels, or shopping on the AmEx platform. With its excellent rewards and benefits, this card has been a trusted choice for travelers in India for years.

Table of Contents

Overview

| Type | Travel Credit Card |

| Reward Rate | 1% – 18.5% |

| Joining Fee | Nil |

| Best Suited For | Travel & Taj Vouchers |

The American Express Platinum Travel Credit Card is a popular choice for travelers because it offers great rewards and has easy spending targets to unlock benefits.

Right now, there’s a special offer where you can get 2,000 extra Membership Rewards Points if you apply using a referral link. This makes the card even better for anyone who wants to earn more rewards while traveling.

Use the link below to earn 2,000 extra Membership Rewards® points as a referral bonus when you spend ₹5,000 within the first 90 days.

Fees & Charges

| Joining Fee | Nil |

| Renewal Fee | ₹5,000+GST (Total-₹5900) |

| Welcome Benefits | 10,000 MR Points |

| Renewal Fee Waiver | NIL |

| Fuel Surcharge | 1% Fuel Surcharge Waiver (Up to ₹1,000 Each Statement Cycle) |

The American Express Platinum Travel Credit Card does not have specific renewal benefits or fee waiver conditions, but you may be eligible for a retention offer based on your spending or profile, which could include a full fee waiver.

Keep in mind that the reward rate may decrease slightly when factoring in the renewal fee. However, there are smart ways to manage this, which we’ll cover later in the article.

Charges

- 0% Convenience fee on fuel purchase at HPCL for transactions less than Rs. 5,000 and 1% Convenience fee on fuel purchases per transaction is applicable for all transactions of Rs. 5,000 and above

- There are no additional charges for redeeming your rewards with the American Express Platinum Travel Credit Card.

- The foreign currency markup is 3.5% + Service Tax

Rewards

For every ₹50 spent with the American Express Platinum Travel Credit Card, you earn 1 Membership Rewards Point. You will not earn any Membership Rewards (MR) points on spending for fuel, insurance, or utility services. However, you can use Amazon Wallet for making utility and insurance payments.

You can earn 3X rewards points when you use the American Express Platinum Travel Credit Card with the Rewards Multiplier. You can select an Amazon gift card through the Amex Rewards Multiplier and make payments using multiple sources from your Amazon wallet.

The reward points earned on the American Express Platinum Travel Credit Card are mainly for transferring to Marriott or redeeming Taj vouchers.

The rewards you earn will not expire. You can use them anytime without worrying about a deadline.

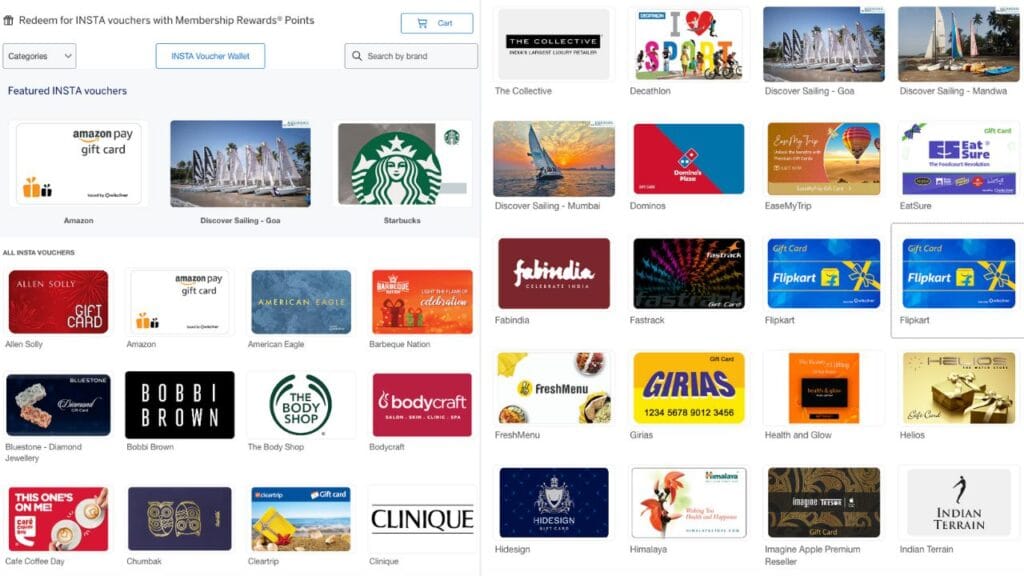

Rewards Redemption

Transfer MR Points to Airlines/Hotel Loyalty Programs

The MR points from the American Express Platinum Travel Credit Card are highly flexible and can be transferred to several airline and hotel loyalty programs. By choosing the right transfer partner, you can get greater value from your points. Marriott Bonvoy is one of the top options, offering a 1:1 transfer ratio.

| PARTNERS | CONVERSION VALUE |

| Marriott Bonvoy® | 100 MR Points = 100 Marriott Bonvoy Points |

| Asia Miles™ | 800 MR Points = 400 Asia Miles |

| British Airways Executive Club | 1,200 MR Points = 600 Avios |

| Emirates Skywards | 800 MR Points = 400 Emirates Skywards Miles |

| Etihad Guest | 1,600 MR Points = 800 Etihad Guest Miles |

| Hilton Honors | 1,000 MR Points = 900 Hilton Honors Points |

| Qatar Privilege Club | 500 MR Points = 250 Avios |

| Singapore KrisFlyer | 800 MR Points = 400 KrisFlyer® Miles |

| Virgin Atlantic Flying Club | 800 MR Points = 400 Virgin Points |

Milestone Benefit

The American Express Travel Credit Card is perfect for individuals who spend more than ₹4 lakhs annually. With its exclusive rewards and benefits, it provides great value for those who make significant yearly purchases.

| SPEND MILESTONE | Rewards | Bonus Rewards | Total Rewards | Values |

| 1.9 L Spends | 7,500 MR | 7,500 MR | 15,000 MR | ₹15,000 |

| 4 L Spends | 10,000 MR | 25,000 MR | 25,000 MR | ₹25,000 |

Additionally, complimentary Taj Stay Voucher worth ₹10,000 upon spending ₹4 lakhs.

Please note that the calculation above is based on the value of “1 MR = ₹1” which can be easily obtained through transfers to Marriott Bonvoy.

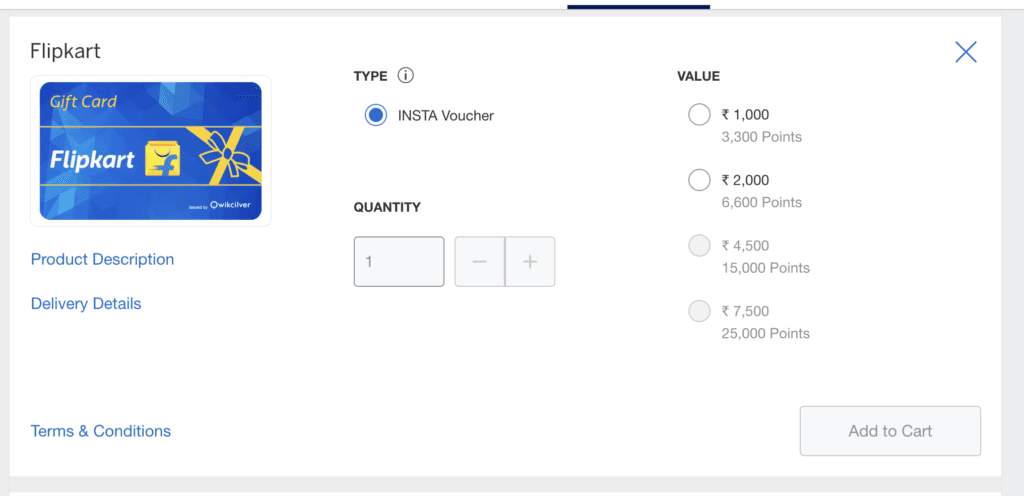

With the American Express Platinum Travel Credit Card, you can redeem your MR points for Amazon or Flipkart vouchers at a rate of “1 MR = 0.30 INR.” However, this may not be the best option.

If you spend ₹4 lakhs using the Amex Rewards Multiplier, you will earn 24,000 MR points. (At a rate of 1 MR per ₹50, spending ₹4 lakhs earns you 8,000 MR points, and with 3X rewards, that total becomes 24,000 MR points).

In total, you can earn 64,000 MR points (24,000 MR points for spending ₹4 lakhs and 40,000 bonus MR points), plus a ₹10,000 Taj Stay Voucher.

The reward value with the American Express Platinum Travel Credit Card is up to 18.5%.

Note: When you hit milestones, you’ll initially receive 7,500 and 10,000 MR points. For the remaining MR points, just reach out to customer support, and they will quickly add them to your account.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

| Domestic Lounge Access | Amex | 8 (2/qtr) |

| International Lounge Access | Priority Pass | – |

Eligibility

The eligibility criteria for the American Express Platinum Travel Credit Card are based on income and age, as outlined below.

- The applicant must be at least 18 years old.

- The applicant must be a resident of India.

- Both salaried and self-employed individuals must have an annual income of ₹6 lakh or higher.

- Self-employed individuals must have their business operating for at least 12 months.

How to Apply

The quickest method to apply for American Express Cards in India is online.

At the moment, you can take advantage of a limited-time offer that gives you an additional 2,000 MR points when you apply using a referral link.

***Best Credit Card for Travel***

Note: It’s recommended to apply using your Aadhaar address, as using a different address may lead to the rejection of your application.