Tata Neu Plus credit card is best suited for individuals who frequently use UPI payments. The RBI’s decision on June 9th, 2022, to facilitate credit card payments through UPI (Unified Payments Interface) marked a revolutionary moment for digital payments in India. This strategic move is intended to significantly enhance UPI’s outreach by permitting users to connect their Rupay credit cards to the platform. Although HDFC Bank has already implemented Rupay credit card integration, it’s worth noting that not all credit card issuers currently endorse UPI payments. In essence, this development signifies a pivotal advancement in widening access and enhancing convenience for credit cardholders in India’s rapidly expanding digital economy.

This highlights the importance of having a good Rupay Credit Card. A card issued on the HDFC Bank platform is an excellent option. With this launch, HDFC also discontinued its policy of issuing only one card per person (possibly limited to Tata Neu cards). Previously, individuals could get a second HDFC card through approval for high net worth customers and via branches only.

In the future, the UPI facility is planned to be extended to Visa and Mastercard credit cards, but the timeline for implementation is currently unknown.

Table of Contents

Overview

- 2% back as NeuCoins on Non-EMI Spends on Tata Neu and partner Tata Brands. For list of eligible partner brands.

- 1% back as NeuCoins on UPI spends (including spends on partner Tata Brands) – maximum of 500 NeuCoins per calendar month.

- 1% back as NeuCoins on Non-Tata Brand Spends and any Merchant EMI Spends.

- Earn additional 5% back as NeuCoins on selected categories on Tata Neu App/Website, post downloading Tata Neu App and registering for Tata NeuPass.

Eligibility Criteria

To qualify for this credit card, applicants must meet the eligibility requirements set forth by the HDFC bank.

Documents Required

For Salaried Indian National

Age: Min 21 years & Max 60 Years

Net Monthly Income more than ₹25,000

For Self-Employed Indian National

Age: Min 21 years & Max 60 Years

ITR more than ₹6,00,000 per annum

Fees

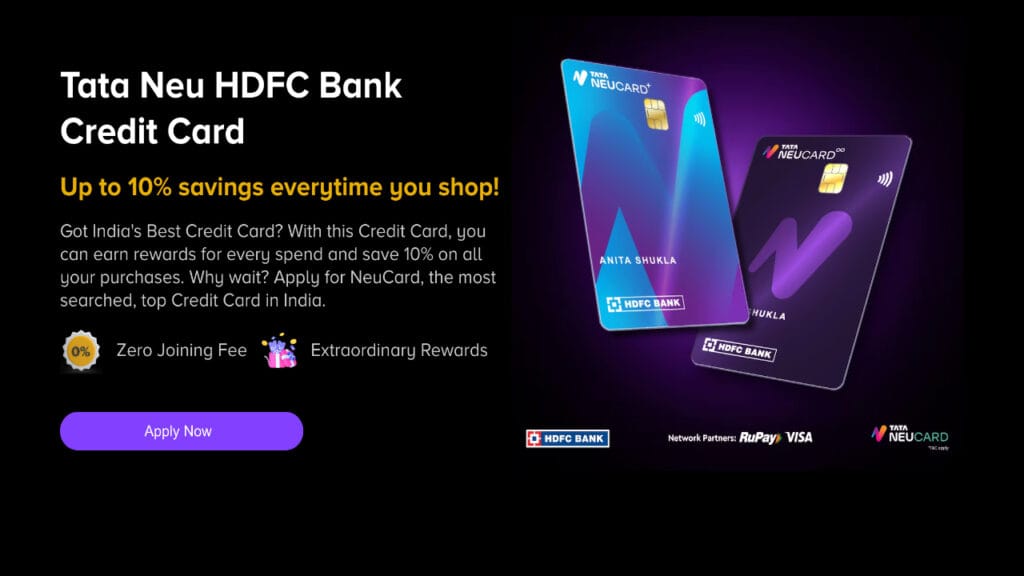

HDFC Bank has launched two co-branded credit cards in partnership with TATA Neu: the entry-level TATA Neu Plus and the more premium TATA Neu Infinity. Both cards are available on either the Visa or Rupay platform, based on customer preference.

Currently on Invite model, the joining fee will be ₹499 ₹0

*Note: Zero joining fee offer for limited time only*

After the initial offer period ends, there will be a joining fee.

| Joining Fee | ₹499 |

| Renewal Fee | ₹499 |

| Renewal Fee Waiver | Annual Spend ₹1,00,000 or more |

Rewards

- 2% back as NeuCoins on Non-EMI Spends on Tata Neu and partner Tata Brands. For list of eligible partner brands

- Tata CliQ

- Big Basket

- Croma

- Titan

- Tanishq

- Air India

- Air India Express

- Tata 1MG

- TAJ group of Hotels

- Westside

- Tata Play

- Tata Pay

- Cult

- 1% back as NeuCoins on UPI spends (including spends on partner Tata Brands) – maximum of 500 NeuCoins per calendar month.

- 1% back as NeuCoins on Non-Tata Brand Spends and any Merchant EMI Spends.

- Earn additional 5% back as NeuCoins on selected categories on Tata Neu App/Website, post downloading Tata Neu App and registering for Tata NeuPass.

- 1 Neucoin = ₹1 each, and it will be credited on the Tata Neu app for shopping on its platform.

Rewards of TATA Neu Plus on UPI Spends

Tata Neu Plus credit card currently provides a 1% NeuCoins reward as the base for payments made through UPI, offering a valuable benefit.

HDFC Bank announced that it will limit rewards points (RPs) earned on UPI transactions to 500 per month across all HDFC Rupay credit cards. This means the maximum spending to earn 500 RPs will be around Rs. 50,000 per month.

The original system for earning NeuCoins rather than RPs is somewhat unclear. So far, I have received 1% on all transactions, but keep in mind that this payout rate could change in the future based on the rule limiting payouts to 500 NeuCoins per month.

Airport Lounge Access

You have 4 complimentary domestic airport lounge visits per calendar year (1 visit per quarter). Your Tata Neu Plus credit card will be charged ₹2 (VISA/RuPay) for each lounge visit.

How to Apply

The SBI Cashback Credit Card can be applied Online.

By utilizing this referral link to complete your online application, you can get the joining fee will be ₹499 ₹0.

Bottom line

Currently, No MDR is charged to customers who use their Rupay Credit Card on UPI. The NPCI is likely working to make this arrangement mutually beneficial for banks, customers and merchants.

I hope the user experience with Rupay and UPI improves over time across all apps and payment gateways, enhancing convenience without compromising rewards.